IRS Launches Preparer Directory

Searches Offer Little Info About Identified Preparers

by Jon A. Hayes, Executive Director

staff@iaam.net

by Jon A. Hayes, Executive Director

staff@iaam.net

February 6, 2015 -- After almost 4 years of promises and missed deadlines, the IRS has finally launched a searchable directory of tax preparers who possess a Preparer Tax Identification Number (PTIN) and either possess an approved credential (CPA or EA) or have completed an Annual Filing Season Program (AFSP). The directory does not include non-credentialed PTIN holders who have not completed the AFSP.

The directory is accessible from irs.gov if one clicks "Choosing Your Tax Professional" under "News" on the homepage, or has access to the direct link released by the IRS this week:

http://irs.treasury.gov/rpo/rpo.jsf

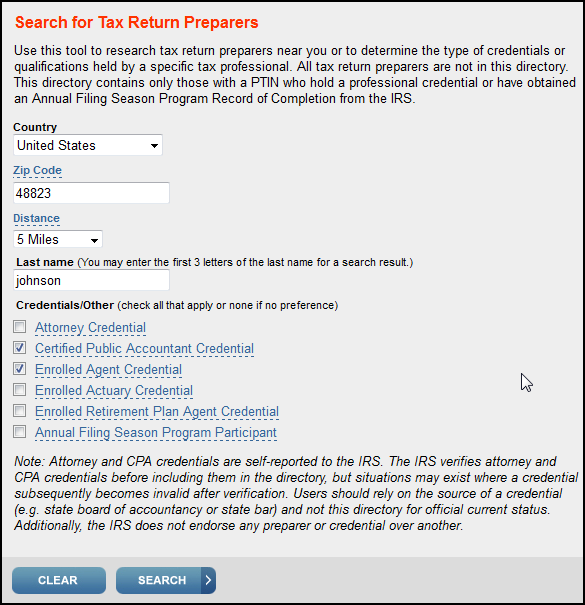

The search engine is simple and easy to use as you can see from this screen shot:

However, once a taxpayer completes the search, all that shows up is a preparer's name, credential, city, zip code, and approximate distance from the searcher's location. There is no way to access a preparer's PTIN profile or to contact the preparer by email or telephone from the search -- items the IRS had promised as the directory was being developed.

However, once a taxpayer completes the search, all that shows up is a preparer's name, credential, city, zip code, and approximate distance from the searcher's location. There is no way to access a preparer's PTIN profile or to contact the preparer by email or telephone from the search -- items the IRS had promised as the directory was being developed.Consequently, a taxpayer must conduct additional searches to find a preparer's location, and to conduct additional due diligence (Better Business Bureau searches, etc.).

So far, all we've seen in publicizing the new directory are electronic press releases to practitioner organizations. Our searches have not produced news items or internet hits from non-tax community concerns, so it is likely that a vast majority of taxpayers won't know the directory exists until after their 2014 returns have been prepared.

Sure, this is a good "first step" in separating reputable preparers from the "unscrupulous" preparers the IRS is trying to weed out. But to really make this an effective tool, we believe an independent website must be developed that provides detailed descriptions about the credentials directory preparers possess, how they were earned, and how they are maintained. It must also provide access to PTIN profiles for the preparers located via searches, along with independent quicklinks that can be used to verify the legitimacy of a located preparer.

Most importantly, the site must possess a complaint-filing system a taxpayer can use when needed that the IRS can quickly address and try to resolve upon receipt.

And finally, a reasonable portion of the millions in PTIN fees collected since 2012 should be invested in widespread AND sustained publicity and public information campaigns that actually drive taxpayer traffic to the site.

Until then, this is subpage on irs.gov that will be buried deeper into cyberspace with each new layer of information added to the site.

Related: IRS Launches Tax Preparer Directory